irs tax levy form

To start the form use the Fill camp. Levy Associates is a tax consulting firm that has helped countless individuals with their taxes.

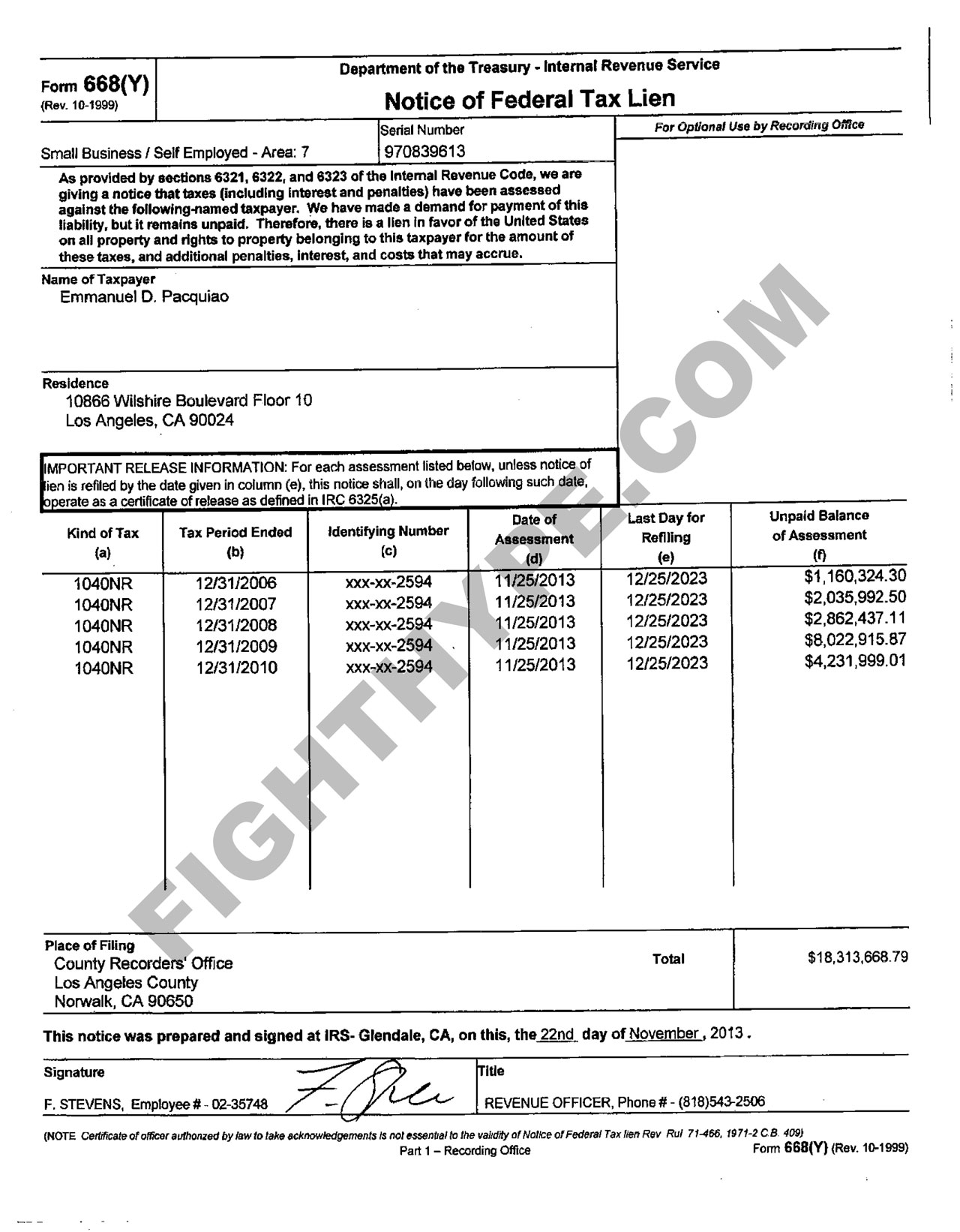

Irs Notices Form 668 Y C Understand Form 668 Y C Lien Notification

Contact Levy Associates Tax Consultants.

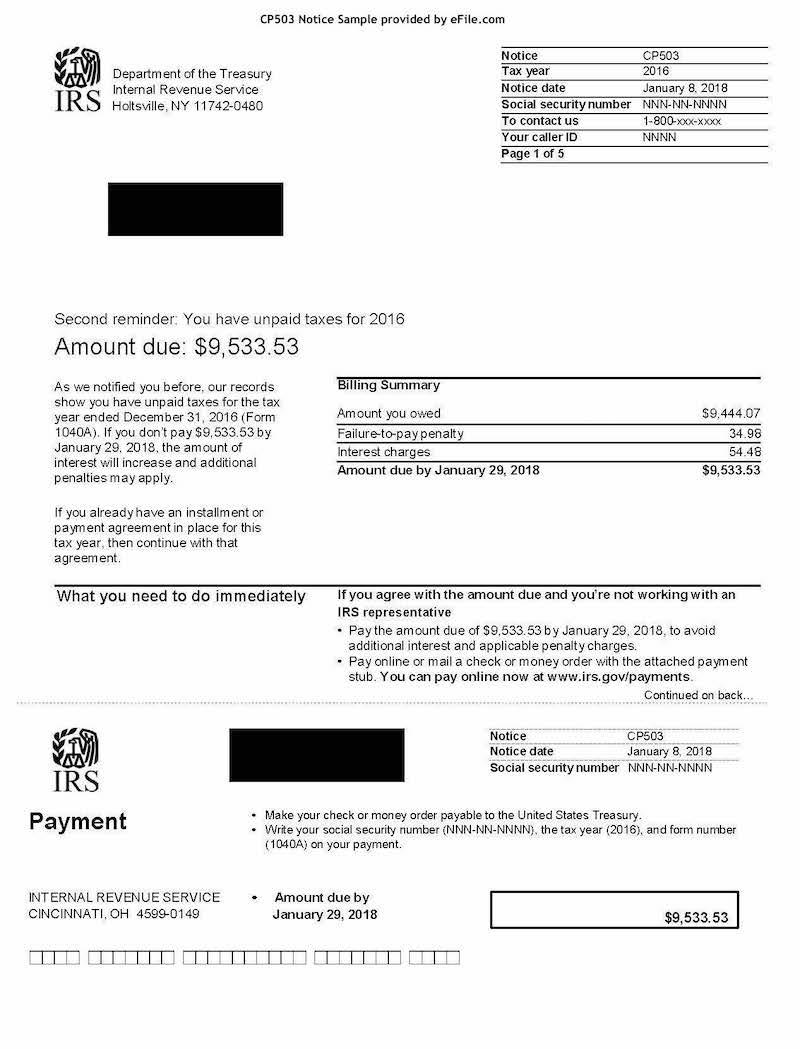

. Ad Remove IRS State Tax Levies. The form can be filed electronically and is a potential option for tax bills of 50000 or less. If you do not agree with the notice you can file an appeal.

What is an Offer in Compromise. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assetsIt is different from a lien while a lien makes a claim to your assets as. Make use of a electronic solution to generate edit and sign contracts in PDF or Word format online.

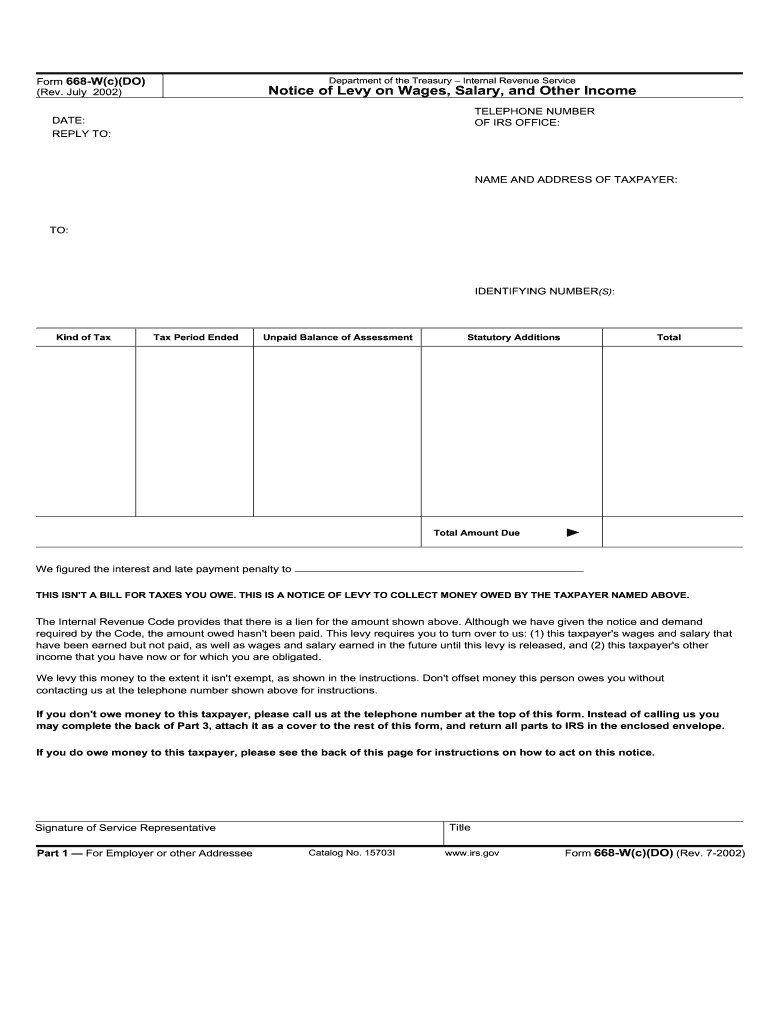

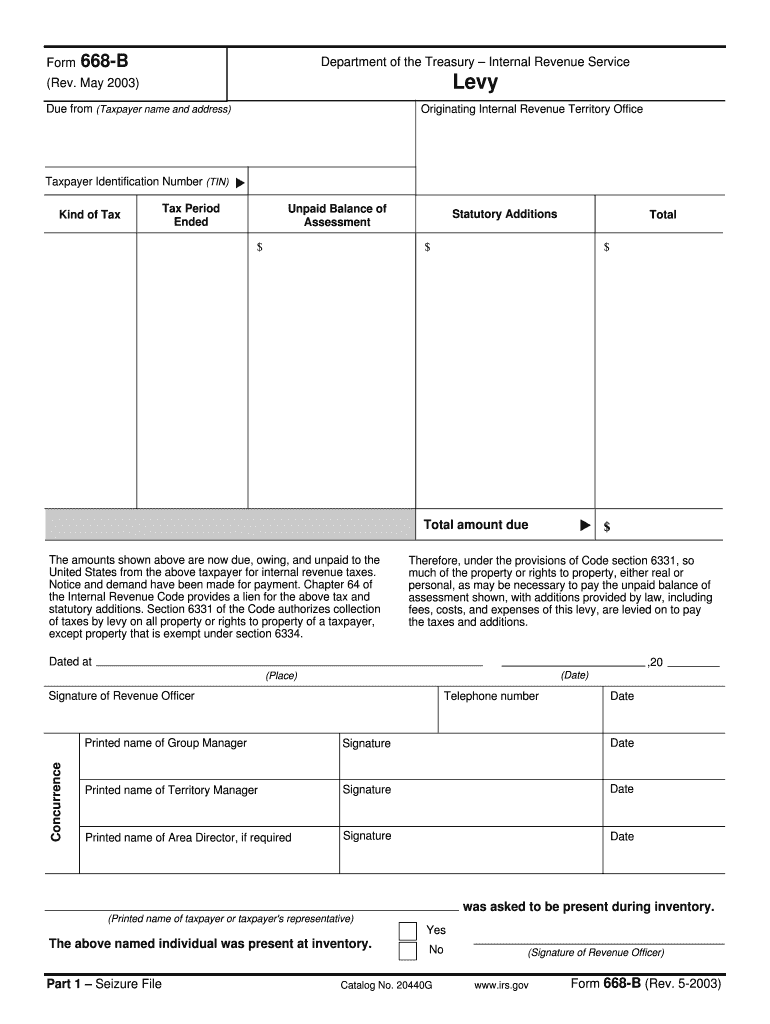

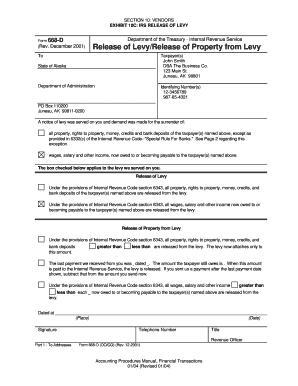

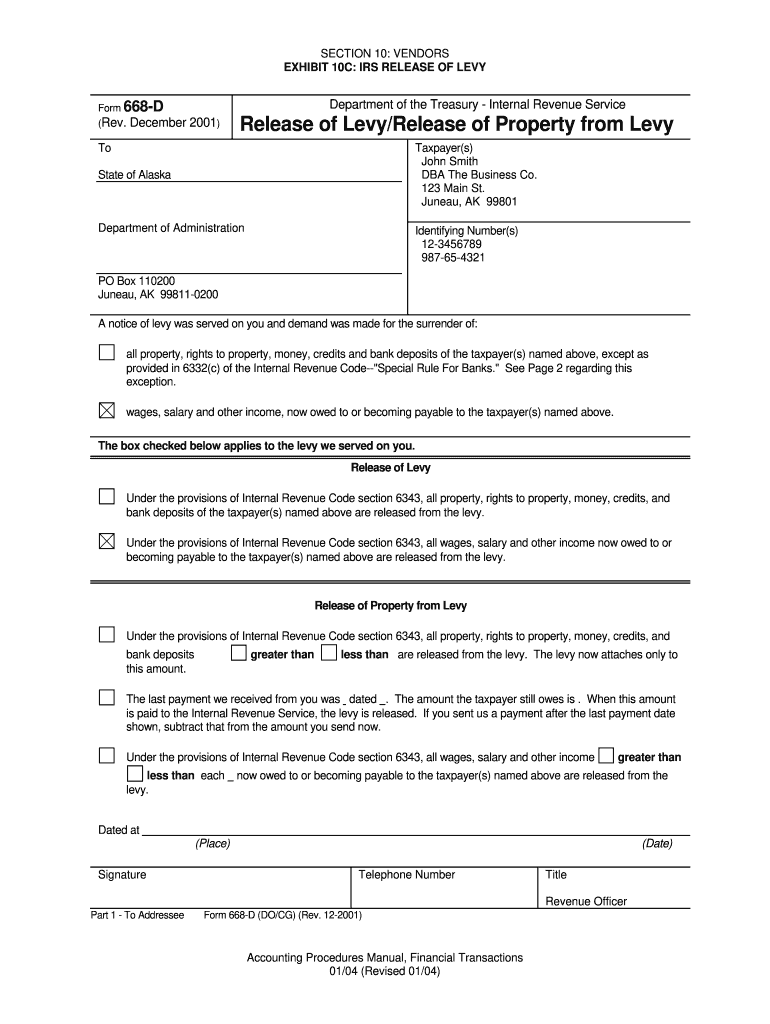

Department of the Treasury Internal Revenue Service Notice of Levy on Wages Salary and Other Income Form 668-WcDO Rev. An IRS levy permits the legal seizure of your property to satisfy a tax debt. How to Request an Appeal for a Tax Levy.

A continuous wage levy may last for some time. Ad Quickly End IRS State Tax Problems. We can assist you with any IRS Form including 1040-V.

The IRS can also release a levy if it determines that the levy is causing an immediate economic. Levy Associates can also help. A single taxpayer who is paid weekly and claims three dependents has 50290 exempt from levy.

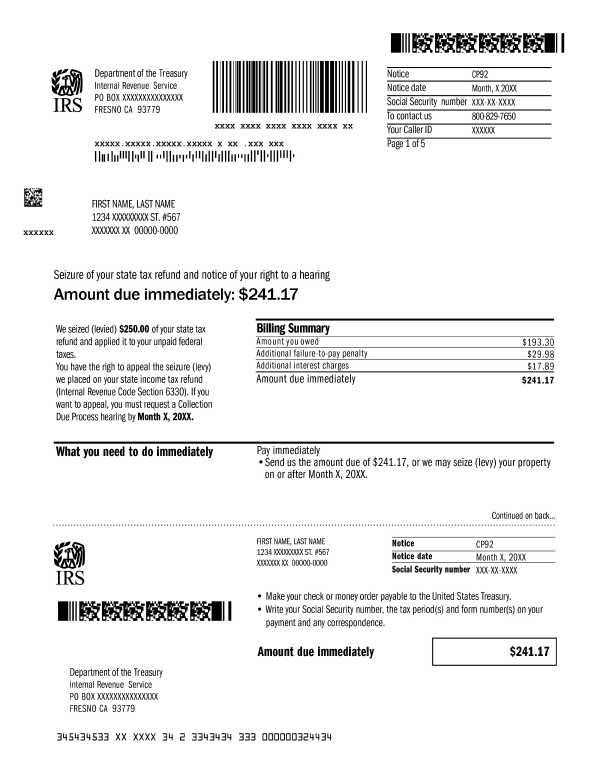

Ad 668-WcDO More Fillable Forms Try for Free Now. No Fee Unless We Can Help. Taxpayers are not entitled to a pre-levy hearing under IRC 6330f4 if the levied source is a state tax refund the IRS has issued a disqualified employment tax levy or the tax.

Under the provisions of ARS. This letter is notifying you that a levy was sent to your employer bank or business clients. However when IRS systems issue Form 668-W IRS.

Sign Online button or tick the preview image of the document. IRS Form 2290 Heavy Highway Vehicle Use Tax Return is commonly used by truckers and others who spend the bulk of their working hours on the road. October 29 2009.

When all the tax shown on the levy is paid in full the IRS will issue a Form 668-D Release of LevyRelease of Property from. A tax levy under United States Federal law is an administrative action by the Internal Revenue Service IRS under statutory authority generally without going to court to seize. Trusted Reliable Experts.

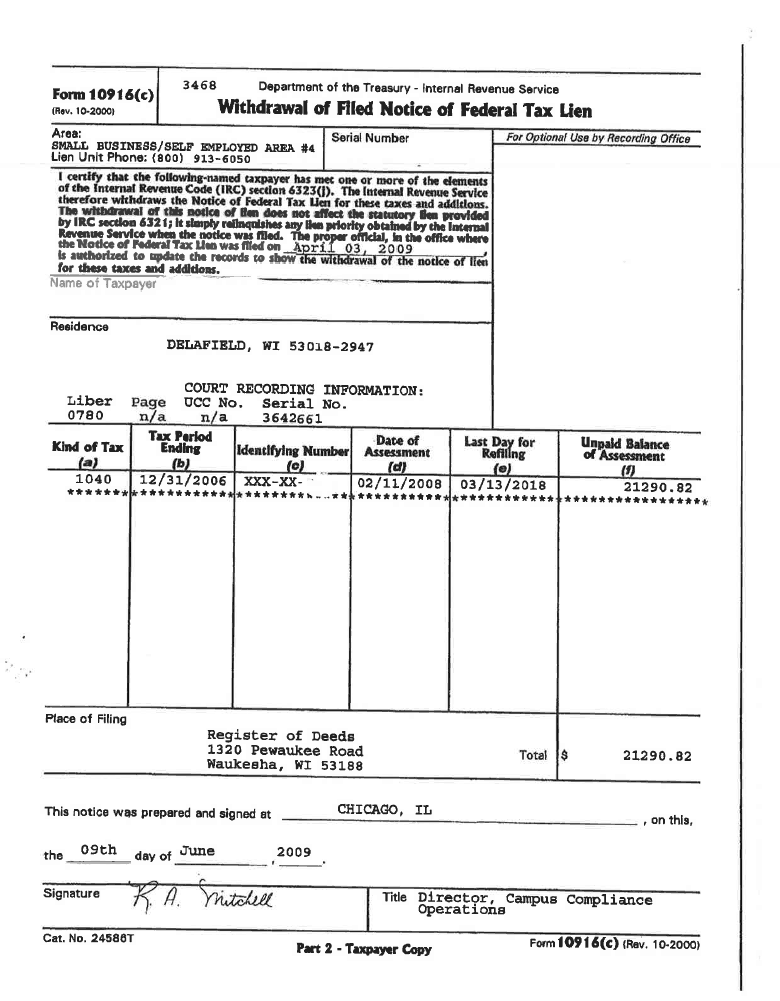

To do that you need to fill out and submit IRS Form 12153 Request for a Collection. A lien is a legal claim against property to secure payment of the tax debt while a. Get Your Qualification Analysis Done Today.

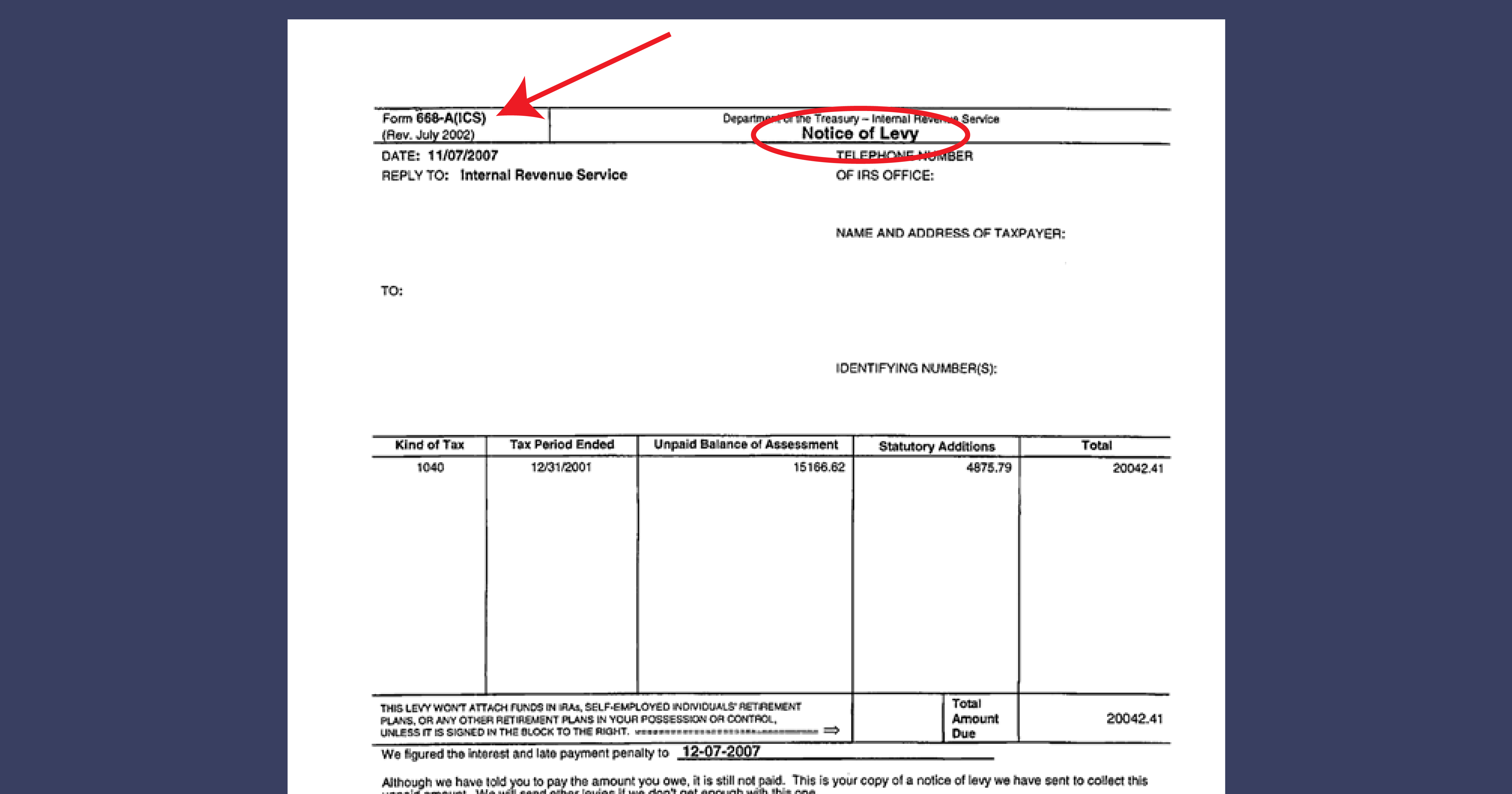

Take Avantage of IRS Fresh Start. The way to fill out the Irs form 668 d release of levy on the web. IRS Levy - Form 668-a.

To get more information or. Levies are different from liens. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

Contact the tax attorneys at Levy and Associates for additional information. The first thing to do is to check the return address to be sure its from the Internal Revenue Service and not another agency. The forms used are Form 433-A for wage earners and self-employed.

The IRS sometimes issues the correct notice of levy- the Form 668-A which provides only for a one-time levy. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Solution to resolve your tax problem.

The most common form of tax levy is wage garnishment. Transform them into templates for numerous use. July 2002 THIS ISNT A BILL FOR TAXES YOU OWE.

Get Your Free Tax Review. Review Comes With No Obligation. The Form 668-A Notice of Levy is sent by the IRS to collect back taxes through an account receivables or bank freezing the funds held in that account.

Statement of Exemption 2022 IRS Levy Exemption Chart. Trusted Reliable Experts. In situations where the IRS actions are creating an economic.

What is IRS Form 2290. If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD. Ad Remove IRS State Tax Levies.

Review Comes With No Obligation. The party receiving this levy is obligated to take money owed to you and pay the money to the IRS. If the levy is from the IRS and your property or.

No Fee Unless We Can Help. With his form of levy the IRS can seize wages commissions and other income. A levy is a legal seizure of your property to satisfy a tax debt.

Contact the IRS immediately to resolve your tax liability and request a levy release. The IRS can seize. The advanced tools of the.

Submit Form 9423 to the Collection office involved in the lien levy or seizure action. It can garnish wages take money in your bank or other financial account seize and sell your. Get Your Free Tax Review.

42-1204 the department allows a certain amount to be exempted from levy.

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Irs Form 668 W C Tax Attorney Steps To Stop Wage Levy Taxhelplaw

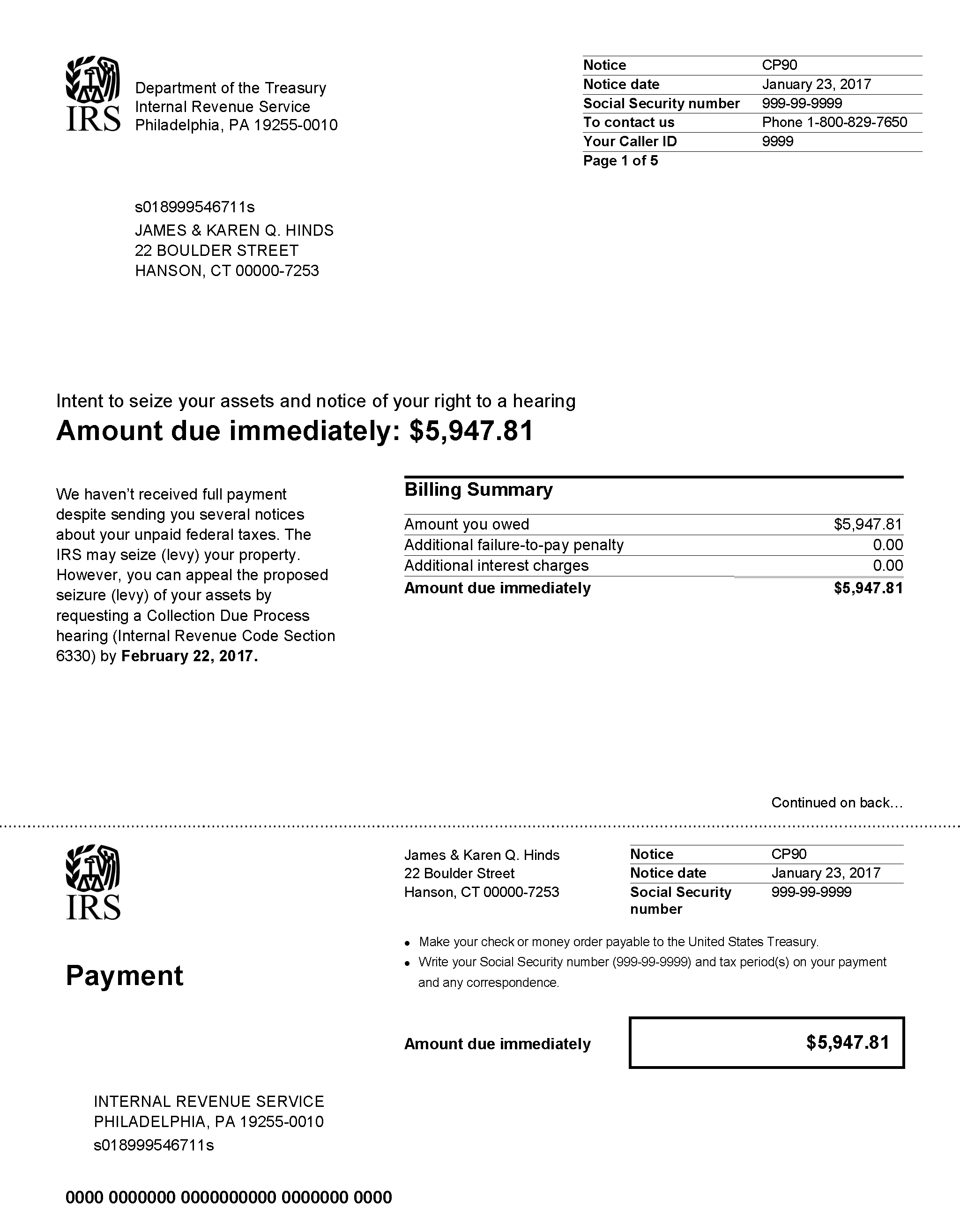

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

What Are The Series 668 Forms All About Astps

Irs Notice Federal Tax Lien Colonial Tax Consultants

Form 668 W 2021 Fill Online Printable Fillable Blank Pdffiller

Irs Form 8519 Understanding Form 8519

Irs Form 668 A Pdf Fill Online Printable Fillable Blank Pdffiller

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Irs Notices And Letter Form 668 A C Understanding Irs Notice 668 A C Notification Of Levy

2003 2022 Form Irs 668 B Fill Online Printable Fillable Blank Pdffiller

Irs Tax Lien Versus Irs Tax Levy

Irs Form 668 D Fill Out And Sign Printable Pdf Template Signnow

Form 668 D Pdf Fill Online Printable Fillable Blank Pdffiller

5 12 3 Lien Release And Related Topics Internal Revenue Service

Irs Leins 9 Ways To Resolve Tax Leins Irs Tax Lien Help Faith Firm